- Home

- >

- News

- >

- Industry News

- >

- Beijing endeavouring to boost China economy

Beijing endeavouring to boost China economy

How low China’s 2020 GDP growth will dip to?

Before the sudden breakout of COVID-19, it was widely anticipated that China’s GDP growth would not slow down too much from the 6.1% growth achieved in 2019, may be at around 5.8-6% for 2020.

The pandemic, however, has totally toppled the prediction before the disastrous situation, and in the post-virus period, Ren Zeping, Chief Economist of Evergrande Group, shared via WeChat that he expected China’s GDP to decline 6% on year for the first quarter while the Q2 was still too early to predict, which could post another year-on-year loss or return to the positive growth zone, just about.

The Beijing-based economist agreed on the prediction, adding, “whether China’s GDP will achieve a gain or how seriously China’s economy will be impacted by the COVID-19 will largely depend on how quickly and effectively the world can bring the pandemic under control.”

“If the battle against the virus in major economies such as Europe and the United States shows encouraging signs by mid- or late April, or if a vaccine can be successfully developed for human injection, the situation may not be too bad and global economy may be on the recovery at a faster pace than expected,” he elaborated. However, a lot of “ifs” have been in the whole projection.

Even so, China’s GDP for 2020 may well fall to an annual growth below 3%, he added.

Where does steel stand in all the disturbing economic environment?

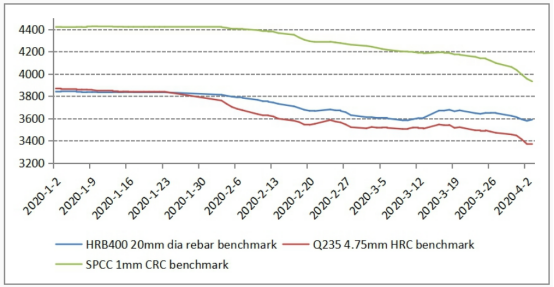

The stalling economy saw many steel-consuming industries besides auto manufacturing tumble, and the impact has been more on flat than long steel, as the injection of funding in infrastructure construction, will at latest cushion on the blow on the long steel products.

Among the supportive measures that may be relevant to flat steel is the government’s decision to delay the introduction of harsher emission standards in the auto industry and to keep the subsidies on the new energy vehicles for another two years until 2022 and a 10% tax waiver until the end of 2020, Mysteel Global noted.

This means that individual consumers will be given a discount of Yuan 15,000-25,000/unit ($2,118-3,530/unit) should they buy a NEV that can run at least 250 km at a single charge, and some local authorities have been allowed to promote car sales by loosening the control or to introduce trade-in subsidies too.

Hangzhou city in East China’s Zhejiang province, for example, has been given the quota to sell another 20,000 vehicles for 2020 on the existing quota.

However, all the measures may fail to revitalize the domestic auto industry much in the near term, especially when the industry urgently needs spare parts, not only the subsidies to the end-users.

“We have reopened for business, but our car makers have not been able to return to normal operations, as some spare parts suppliers have not been back to the full operational mode,” an official from an auto spare parts supplier in East China’s Shandong province said.

China’s flat steel consumption, as a result, may have to bear with the sluggishness much longer than long steel and the continuing softening in flat steel prices.

“We usually procure 40,000-50,000 tonnes of cold-rolled coil (CRC) annually from Baoshan Steel, but this year we will not be able to match the volume,” the Shangdong source disclosed.